Contents

The PRZ is key, as is correct positioning of SL and TP. If my channel suggests a w5 soon in an uptrend, I will look for a bearish harmonic to catch a top retest/failure. I appreciate it and believe it will help the other traders using Harmonic patterns. Hi Rayner, in regards to your article I only trade BAT and Cypher in my 5 Pair currency portfolio. With extensive back testing on both 15m and 1hr charts which is my 2 time frames. Hi I am working on bullish Shark Harmonic patterns, and I have the dataset with the sequence of 5, 4, then after long gap 17.

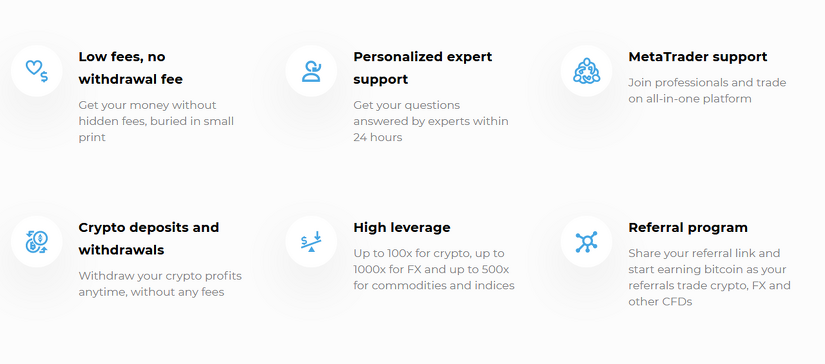

But their success rate is so low in such markets, and their formation can lead to the generation of low quality, low probability trading signals. Use a Libertex demo account to build your favourite harmonic patterns. A Libertex account allows you to trade currency pairs and CFDs. If you trade a bullish pattern, point D is your entry point. Like other harmonic patterns, you need to find confirmation in the form of a reversal candlestick or a technical indicator. There are several harmonic patterns, and each one has a specific shape and figure.

What are Harmonic Patterns: Predicting Future Price Actions

(Ideally in Bat we are looking for a 50% retracement). The main advantage of harmonic patterns is that you won’t need to make guesses because you can rely on specific Fibonacci numbers. This is why using a breakout trade setup as described is beneficial. Let’s assume for a moment that Ether is unable to rally at the 127% zone. If we set up a bullish breakout trade at horizontal resistance, and the price fails to reach the breakout signal, then we never enter into the bullish trade .

What is a harmonic scanner?

Harmonic scanners are tools that help in detecting harmonic patterns used for entering trades. A good harmonic scanner gives an accurate trade signal to traders as soon as a harmonic pattern appears.

Harmonic trading is a kind of technical analysis generally used across futures, stocks and forex. Harmonic trading makes use of particular price patterns which are subject to alignment of specific Fibonacci extension and retracement levels. There are harmonic pattern scanners that identify various patterns as they are forming or complete. Our pattern recognition scannercan be used to isolate some possible trade set-ups.

Harmonic Patterns to make Fibonacci more objective

The harmonic patterns generate signals of upcoming sharp reversals in the currency rates, stocks, indices, etc. In general, these reversals cover a price zone between two Fibonacci ratios, and this is commonly called a Price Reversal Zone . Harmonic trading can be seen as high-probability trading. Harmonic patterns are more reliable in M30 and higher timeframes. The general win/loss ratio of harmonic trading strategies is above 70%.

This is because two different projections are forming point D. If all projected levels are within close proximity, the trader can enter a position at that area. This could be from an indicator, or hft arbitrage ea simply watching price action. Harmonic patterns are chart patterns that form part of a trading strategy – and they can help traders to spot pricing trends by predicting future market movements.

Due to the harmonic wave nature of this formation, we can identify its potential reversal zone ahead of time. That way, if the price does make its way to that zone, we can look for symptoms of a change in trend. Within the realm of technical analysis, chart patterns are popular tools. In this article, we will teach you how to recognize, interpret, and trade this variety of geometric price patterns.

The price chart will have a clumsy look whenever a harmonic pattern indicator is attached to the chart. Seasoned traders always advise beginners to have a clean price chart so that support and resistance levels can be clearly seen. Having numerous lines on the price chart can divert a trader’s focus from important levels. Harmonic patterns are based on the assumption that human beings tend to repeat their past behavior even without their own awareness.

Here is an example of the NZD/JPY Butterfly pattern with some triangles added through our drawing tools. The bullish Butterfly pattern has the same ratios, but the pattern starts with an up XA wave up. The following is a bearish example of the Butterfly on a one-hour NZD/JPY price chart. The B wave retraces to 0.886, which is just slightly beyond but it still quite close to ideal. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Crab & Deep Crab Pattern: A Harmonic Traders Guide

Cory Mitchell, CMT is the founder of TradeThatSwing.com. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies. Another Scott Carney discovery, the Crab follows an X-A, A-B, B-C and C-D pattern, which allows traders to enter the market at extreme highs or lows. The most important feature of the crab pattern is the 1.618 extension of the XA movement that determines the PRZ.

What is a crab pattern?

The Crab pattern is similar to a Butterfly pattern in that it is a reversal pattern composed of four legs marked X-A, A-B, B-C and C-D. The Crab is another reversal pattern that allows you to enter the market at extreme highs or lows.

In this way, a harmonic pattern may be a viable buy or sell signal. And now, we’re ready to dive into the specific types of harmonic patterns! At this point, we’re assuming you know how to read charts, and you have a premium stock broker that gives you plenty of access to data.

How to withdraw the money you earned with FBS?

There is no reason you cannot have different strategies for different market conditions. The algorithm should plot the patterns on the charts and once they have formed, you only look for more confluence….. As a trader, you have to know the pitfalls of your trading approach and apply proper risk management. This way if you do get stopped out of the trade, you clearly know the harmonic pattern has failed. If you read most trading booksor attend trading courses, they will teach you to place your stops just below the support or above the resistance.

I have also been somewhat intrigued by harmonic trading. Mostly because of how many retail traders seem to use it and praise it. For me, the main problem with harmonic patterns is what you mention under point 2 – there is no reasonable mechanism what would explain why patterns like Bat or Cypher should work. I just don’t see why price should regularly turn at specific levels predicted by some fibonacci numbers. Of course, there is one mechanism that could make these patterns work – self-fulfilling prophecy. But for such prophecy to work, the patterns should be very clear and objective.

On March 13, 2021, Bitcoin starts a small correction to the March 25 low. The 78.6% retracement level of this correction is at $59,326. Then, the price rallies to a high of $60,365 on April 1, marking point B. This price high is about an 85.8% retracement, a little larger than the ideal 78.6%, which is okay.

A bearish harmonic pattern is present during an uptrend. These patterns frequently occur and have a history of being repeatable and reliable, thereby producing a high probability of success. Therefore, these patterns provide a clear structure for entry and exit points. According to Scott Carney, the Crab Pattern is the most accurate harmonic pattern. The Crab Pattern is characterized by a high reward-to-risk ratio and a very tight stop-loss order placement.

Step 2: Measure the potential Harmonic Price Pattern

It appears when the price has been moving in an uptrend or downtrend but has started to show signs of correction. Harmonic patterns can indicate reversal points and show how long a price move will last. They are highly precise patterns that require specific calculations. The shark pattern is one of the newer patterns on this list, and has just been in use since 2011. It’s called the shark thanks to its steep outside lines, plus its smaller dip in the middle, causing it to resemble a shark’s fin . In the crab pattern, AB should retrace 38.2%-61.8% of XA.

Last couple of months when market was trending I was busy looking for reversals and missed the whole big USD trend. Have to be more aware of price actions which indicate a strong trend buildup. Just like any other trading strategies Webquik Terminal whether it’s harmonic trading, price action trading, or Trend Following — there are pros & cons to it. If you want to long in a range market but there is no bullish harmonic pattern, you can simply place your bid to long at support.

Harmonic patterns have defined areas for stop placement. But the stops are really tight and can easily be triggered in volatile markets. A forex strategies bullish Gartley pattern will also resemble an ‘M’ and buy orders will be placed at D and stops at or below X, with the profit target at C.

The most important ratio to define is the 0.786 retracement of the XA leg. This helps to plot point B, which will help traders to identify the PRZ. It is similar to the BAT pattern in that the XA leg leads to a BC retracement, except that the retracement of point B must be precisely 0.618 of XA. The stop-loss point is often positioned at point X, while the take-profit is often set at point C.

All harmonic patterns have defined Pattern Completion Zones . These PCZs, which are also known as price clusters, are formed by the completed swing confluence of Fibonacci extensions, retracements and price projections. The patterns generally complete their CD leg in the PCZ, then reverse. Trades are anticipated in this zone and entered on price reversal action.

You can confirm that by observing the D point, you might be able to find reversal formations like tweezer top/bottoms, head&shoulders, double/triple top/bottom and others. Furthermore, harmonic patterns that do appear in trending markets are usually against the trend. When you do trade harmonic patterns in this scenario, you will find yourself cutting your trades many times.

Kommentárok