Contents

This is a similar idea to when you are using the moving average in trend following. In this case, you should look for an entry in the opposite direction. There is no point in holding the trade even if the Stop Loss is set beyond the blue. The trade is moved to the breakeven, according to this strategy, when the Jaw line is below the entry price for a sell trade and above the entry price for a buy trade.

After clicking on Alligator, a dialogue box with the default setting will appear. You can use the default settings or change whichever parameter you want. For example, ‘Apply to’ can be the close price or median price. Additionally, the indicator can help traders identify impulse and corrective waves. However, you only appreciate those better when you combine the indicator with a momentum indicator. The indicator will flash false positives when the three lines are crisscrossing each other repeatedly, due to choppy market conditions.

Williams Alligator Indicator

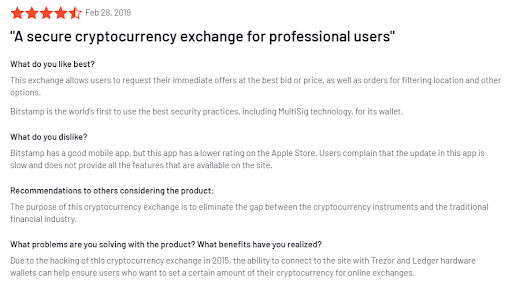

Three lines make the indicator, overlaid on a pricing chart. They represent the jaw, the teeth, and the lips of the beast. Below is an example of the lexatrade review on your price chart on the MT4 trading platform.

The indicator applies convergence-divergence relationships to build trading signals, with the Jaw making the slowest turns and the Lips making the fastest turns. The Lips crossing down through the other lines signals a short sale opportunity while crossing upward signals a buying opportunity. Williams refers to the downward cross as the alligator “sleeping” and the upward cross as the alligator “awakening.”

When the green balance line is above the red one and the red is above the blue, and the price is trading above all the Alligator lines, a buy signal is generated. Green line indicates the balance line of the Lips; it is the weakest level. However, it has the fastest reaction to the price changes. This moving average is the first to react to changes in the balance of power of buyers and sellers in the market. This line is used to add up to the opened positions in the trend if there is strong momentum in the chart.

The indicator is always activated during the period of trend change. When the trend ends, the lines begin to intersect again and go horizontally (the alligator is “sated”). Here, it is recommended to close current positions regardless of the level of current profit/loss. The alligator analogy is designed to help describe some of the behaviours of the market as it goes from non-trending to trending. The idea is that the absence of a trend in the market – i.e. periods of sideways movement – is like a sleeping alligator.

Setting Stop Loss on the indicator lines

You should keep these instruments on your radar especially if price action is hinting at an increase in momentum. The best time to get on board a trend move is just before it happens. You must keep in mind that since we are using displaced moving averages, each of the 3 lines will be plotted ahead of price by the factor of the displacement – 3, 5, and 8 periods.

Candlestick Cross and CloseNote the the green line has crossed over the red to the downside. Remember, these lines are displaced into the future and would have plotted in front of the candlestick we are shorting. Thus, when a support or resistance level forms a confluence with the Alligator lines, a trade setup at such a level will carry a higher chance of success. The moving averages converge when the market is in a range or consolidation, and Bill recommends staying out of the market during such conditions.

The value of the SMMA is calculated as a simple moving average . The main difference is that closing prices are not summed up, but rather the Median Price, the formula for which is shown above. With us, you can trade forex using derivatives such as CFDs. CFDs are leveraged products, which means you can trade on the upward or downward price movements without owning the underlying assets. We research technical analysis patterns so you know exactly what works well for your favorite markets.

When the lip line crosses slower MAs, we could assume that the trend is about to start. I should note that the three balance lines are the moving averages that are applied to the median value ((high+low)/2), not to the bars’ opening or closing prices. The teeth line is the 8-period smoothed moving average that is moved five days into the future. As you know, when we trade forex, the market can be either trending or consolidating. The price moved in momentum for about 30% of the entire time; it trades in correction or accumulation for 70% of the time.

Trading Pullbacks In Price

We recommend that you use the default figures as shown below. In this article you will find out what price fluctuations consist of. You can try trading with the Alligator indicator on the demo account withoutregistration. The Take Profit is set at the distance twice as much that of the stop loss. There is no trading activity at the US session; the market participants are accumulating trading volume. The value in the middle of the data set, with half of the prices higher and half lower.

- The Moving Average Convergence Divergence is both a momentum and trend following indicator.It is calculated by…

- Many traders will enter the market following a candle close above/below all 3 lines at this point.

- The orange ellipse showed that the market is moving sideways.

- Investopedia requires writers to use primary sources to support their work.

- The Williams Alligator is an excellent market analysis tool suitable for both a beginner in training and an experienced professional trader.

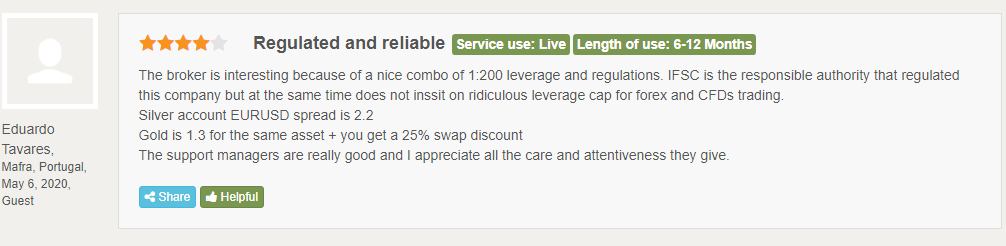

The system allows you to trade by yourself or copy successful traders from all across the globe. Listed below, there are primary advantages and disadvantages of the Alligator, for you to decide if the Alligator trading strategy suits you or not. Any MetaTrader terminal offers such parameters by default. These are the fxtm broker reviews default parameters offered in the LiteFinance client profile. Why should you move the order to the breakeven zone in this case?

Summary of Alligator settings

Let me explain how to trade with Bill Williams’ Alligator indicator. The Alligator indicator was invented to determine the state of the market. The Alligator indicator was created by Bill Williams, an American trader, and psychologist. Williams described the Alligator indicator in his book ‘Trading Chaos’ in 1995. Alligator Indicator works for any asset in any market, such as foreign exchange, currency pair, etc. Team includes professional authors, analysts, and expert traders with a genuine interest in both trading and sharing their expertise with you.

Since we are only taking long positions, we waited until the market correction ended in late December before taking another long position . Although we saw a minor retracement along the line, the market was still well in an uptrend. For a market like this that is often in an uptrend, you can use the Alligator to spot potential retracement and use it to hedge your position. We can therefore say that a crossover of the green line to the upside indicates a buy signal while a crossover to the downside indicates a sell signal.

Pros and Cons of Alligator trading

So now, the alligator has lost interest in the food and it closes its mouth to rest . This is when some traders close their positions if they’ve made a profit, as the upward or downward trend may have come to a halt. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. The creator of the indicator was an early pioneer in financial market psychology. He made some of the most widely used technical indicators today. You can use the Williams Alligator indicator to find the absence of a trend.

The indicator uses a smoothed average calculated with a simple moving average to start. If the price chart is above the indicator we trade online and in a reverse situation when the chart is below the indicator we can buy puts. Dear Traders, there has been happening a lot since my last DAX30 analysis eleven days ago. I have closed my short positions with some profits and kept quite until the beginning of this week, waiting to bring my long trades into the race. If you remember, I revised my initial expectation from ‘call’ to ‘put’ as I expected the correction not be finished – or… Another simple strategy of using the Williams Alligator is in trend following.

During the first trading hours of the European session, the price closes above the Alligator’s mouth. We notice this moment and decide to look for an entry point to buy gold. At the end of the trading session on January 18, 2021 – the beginning of the trading session on January 19, 2021, the Alligator fell asleep. This market state is characterized by uncertainty, and one shouldn’t enter trades during this time. With the beginning of the trend, it begins to “open up” and “eat.” Let’s take a look at what signals the Alligator generates. Next, the lip line is the first to react, as it is the fastest.

Once the lines have shown a direction, you can resort to using a price pattern that is a staple of all traders – pullbacks. There are several trading strategies you can use and keep in mind that all indicator based strategies do lag the market. “Displaced” means that the reading is adjusted X bars into the future which is believed to better forecasts future trend direction. You can use them to know the right time to enter a trade after you have identified a trade setup with the powertrend. Conversely, in a downtrend, pullbacks move upward and usually end at resistance levels.

Kommentárok